In a world filled with uncertainty—from geopolitical tensions to breakthroughs in artificial intelligence—imagine a market where you can bet directly on the future.This is not casino-style gambling, but a highly complex system that relies on the wisdom of crowds to predict the future with astonishing accuracy.Welcome to prediction markets, the “crystal ball” of modern society.

By 2025, these platforms have ceased to be niche experiments and have rapidly swelled into multi-billion dollar phenomena where finance, technology and human intuition intersect.Taking the 2024 U.S. election as an example, Polymarket’s transaction volume exceeded $1 billion during the election, and its prediction accuracy far exceeded traditional polls.Now, in 2025, the market is expected to reach new highs, with nominal trading volume expected to reach $30 billion, a 40% annual increase from $16.3 billion in 2024.

Predicting the future is not a new thing that will appear in 2025.From the stock market’s pricing of corporate prospects to insurance’s quantification of risks, human society has been putting a price on the future.Prediction markets just take this logic to the extreme: breaking down future events into contracts and letting market prices reflect the probability of occurrence.The real changes will occur in 2025: transparent settlement on the chain, global threshold-free participation, the parallel development of social portals and compliance platforms will turn the prediction market from a fringe hobby into a track that capital, media and institutions cannot ignore.

01|Understanding the mechanism: principles and types

What is a prediction market?

Prediction markets (also known as information markets, event derivatives, etc.) are trading platforms that allow participants to bet on “yes/no” or multiple options around a certain future event.After the contract expires, if the option you bought “happens”, you will get a fixed income (usually $1/contract unit), otherwise you will lose your betting funds.

The core of trading is: contract price = probability that the event is believed to occur – the market constantly adjusts this probability through buying and selling behavior.

Types and modeling mechanisms

Prediction markets can have many architectural styles, and different designs determine their performance and limitations:

On the other hand, contract types are not always as simple as “binary (yes/no)”: some contracts may have multiple options, and some may be scalar (numeric range).The clearer the design and the higher the verifiability of the contract, the more trust and liquidity support it can gain from users.

Information aggregation vs operational risk

The core value of the prediction market lies in the “aggregation of wisdom”: each trader makes a bet based on his own information judgment, so that the market price integrates everyone’s opinions.But this also brings operational risks: manipulation by large players, bubbles, market bias or opinion exhaustion (ie, most people read similar information), etc., may distort prices.

02|Three main lines of 2025: compliance, social embedding, and exchange

2.1 Compliance landing: Kalshi connects supervision and distribution

-

After a long period of struggle with regulation, the regulated election prediction contracts in the United States were cleared by the court, and the compliance model effect appeared. Afterwards, Kalshi further opened up with Robinhood and directly inserted the NFL and college football prediction portals into mainstream brokerage apps, significantly expanding the reach radius.

-

For a wider range of users, “betting on real events like buying options” has become an understandable product paradigm, and it has also allowed the prediction market to move from the native encryption circle into a larger financial distribution network.At the same time, the narrative of federal regulation + cash settlement strengthens the mentality of “safety and trustworthiness”.

2.2 Decentralization breaks the circle: Polymarket’s scale and voice

-

Growth and scale: During the 2024 election window, Polymarket trading volume exploded from $62 million in May to $2.1 billion in October (+3268%), and has since maintained billions of dollars of monthly activity in 2025.

-

Attention and citation: Mainstream media (CNN, Bloomberg, etc.) quoted odds data in live broadcasts, and traditional public opinion and on-chain data began to “dual-track comparison”.

-

Ecological niche: Currently, about 90% of the funds are concentrated on Polymarket and Kalshi (decentralization/centralization bipolar), and the valuation and moat of the leading platform are rising rapidly.

2.3 Social embedding and experience upgrade: from “jump” to “place betting”

-

Content is the entrance: Myriad, Flipr, etc. embed the betting port directly into the news flow and social conversations (browse/discussion → one-click betting → return to discussion), reducing the friction “from information to transaction” to an extremely low level.

-

Exchange-based penetration: Solana’s Drift adds a BET prediction module to the derivatives terminal; Base’s TryLimitless uses on-chain CLOB (central limit book) to reshape the pending order matching experience; while Hyperliquid proposes Event Perpetuals (information sustainability), using a design of “continuous trading, one-time settlement at maturity” to solve the problem of binary market flow and slippage.

Summary: Compliance and distribution allow for the influx of incremental users, on-chain innovation increases efficiency and playability, the “content-transaction-settlement” link is compressed, and the prediction market moves from a single application form to a product matrix and multiple entrances in parallel.

03|Popular application scenarios

-

Sports predictions: NFL and new season events have led to a new round of craze. Contracts cover game results, player data and even real-time events. The prediction accuracy is often higher than that of experts.

-

Encryption and DeFi: Enterprises and investors use prediction markets to hedge regulatory and macro risks, RWA tokenization allows stocks and real estate to enter on-chain predictions, and privacy technologies such as FHE improve compliance.

-

AI empowerment: AI models enter the market as virtual traders, learn, predict, and even provide automated betting services in real time.

-

National security: The U.S. intelligence agency is studying the inclusion of prediction markets in threat analysis, and issues such as the situation in the South China Sea and sanctions policies have become reference signal sources.

04|Main prediction market platforms

-

Polymarket: The decentralized overlord, the annual transaction volume is expected to exceed US$35 billion in 2025.

-

Kalshi: Compliance representative, connected to Robinhood, focusing on elections, macro and financial events.

-

PredictIt: A platform with an academic background, good at political predictions, but with a low betting limit.

-

Emerging players: TryLimitless (base chain) uses CLOB to optimize transactions, Talus Labs explores AI-driven predictions, and Noasight is a prediction market on the Sui chain with active ecological innovation.

05|Product and mechanism design: from AMM to CLOB, to information sustainability

-

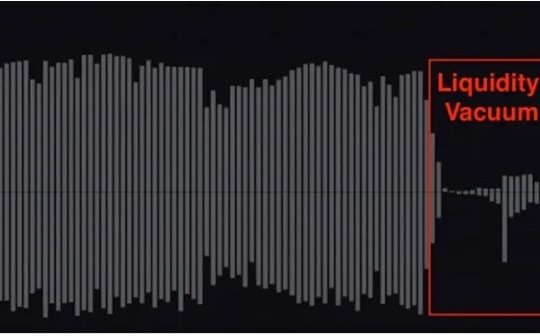

AMM binary pool: suitable for rapid creation and long-tail markets, but prone to price jumps and liquidity drying up near settlement.

-

CLOB (on-chain order book): friendly to market making and high frequency, and depth and price discovery are closer to traditional exchange logic.TryLimitless uses CLOB to handle multi-outcome/multi-leg positions, locking in profits and losses in advance, and the experience is more like an “event option”.

-

Information Persistence (Event Perps): Introducing continuous trading curves, anchoring 0/1 at one time during settlement, without the need for high-frequency price feeds during the period, turning “news and probability” into a time series that can be long and short; this path is designed to undertake larger-scale speculation and hedging needs.

-

Oracle and ruling: The credibility of the result writing is fundamental.The mainstream on the chain mostly uses third-party oracles + dispute arbitration, but the boundaries of the ruling and the transparency of the process directly determine the credibility of the platform (see §05 Risk).

06|Participation and realization: from “betting on direction” to “making strategy”

If you think of prediction markets as just “betting on who wins,” that’s just an introduction.The real gameplay is to treat it as a synthetic options and information exchange, and establish a systematic strategy around “pricing deviation – information lag – structural incentives”.

-

Cross-platform price difference arbitrage: When the implied probabilities of the same event on CEX/compliance platforms/on-chain platforms are inconsistent, buy low and sell high to achieve risk-free expectations; semi-automated execution can be achieved with the API.

-

Do AMM LP: Earn handling fees in the hot market, use “delta near-neutral” positions to hedge directional exposure, and obtain liquidity premiums.

-

Bayesian update vs. market lag: Establish an “event-probability” update model, adjust positions before the public disposes, and absorb the information-execution time difference.

-

Odds – asset linkage: Use predicted odds to guide on-chain/centralized derivatives (such as sustainable linkage transactions with BTC/ETH), and get stuck in the “pre-announcement” position.

-

Combinations and conditional orders (Parlays/multi-legs): Connect the previous and later correlations such as “primary election – general election” and “data release – asset trend” in series to create a path-dependent risk/return structure.

Risk control tips: Use simplified Kelly or fixed proportions for budget allocation; a single market should not exceed 1-3% of the total funds; priority should be given to locking profits near settlement instead of “gambling the end game”.

07|Confronting the Dark Side: Oracles, Manipulation, Regulation and Ethics

Oracles and Judgment Disputes

On-chain settlement is highly dependent on the “external truth” of the oracle.In the past year, there have been disputes in the interpretation of results and the decision-making process in some markets with very large capital volumes: for example, differences in understanding of news wording/judgment standards have led to judgments that are contrary to the intuition of most participants in markets with a scale of tens to hundreds of millions of dollars. Users have accused the results of biasing “in favor of large position holders.”Such incidents directly erode the trust of the platform, and also force the upgrade of the predictability of the rules and the transparency of the appeal process.

Manipulation and “Reflexivity”

Prediction markets may shape events in the opposite direction: when market results affect public opinion and behavior, big money creates narratives and affects information sources, thereby affecting rulings and prices.Design solutionsIncluding: multi-source oracles, delayed settlement windows, clear/machine-determinable condition descriptions, and the redesign of incentives and penalties for adjudicators.

Regulation and geographical differences

The centralized compliance path and the decentralized free path will coexist for a long time.Regulated cash settlement platforms provide stronger compliance and consumer protection, while decentralized platforms are globally accessible, censorship resistant, and innovative in speed.The two ends are ebbing and flowing, and together they are raising the ceiling of the industry.

Ethical Dilemma Betting on events such as wars and disasters has triggered social controversy.

08|From “Application” to “Infrastructure”: Where are we heading?

-

Distribution layer: The deep integration of the compliance platform and the brokerage app, and the superimposition of social/content native portals, turn predictions from “destination” to “actions along the way.”

-

Matching layer: CLOB and information sustainability bring the experience and capacity of event trading to the “exchange level”, allowing for greater leverage, more complex combinations, and a wider range of themes.

-

Ecological layer: Funds and liquidity are highly concentrated in the head bipolar (Polymarket×Kalshi). At the same time, peripheral front-ends, robots, data indexes, and market-making tools have sprung up. The industry has evolved from “single-point platform competition” to “multi-role collaboration network.”

Conclusion

The prediction market is not a universal crystal ball, but it can price uncertainty and aggregate scattered information into probabilities.It is not only a risk hedging tool for investors, but also a decision-making aid for institutions. It is also a “probability window” for the public to peek into the future.

In the future, the path of the prediction market will gradually become clearer:

-

Compliance and decentralization go hand in hand: while being integrated into the mainstream financial system, innovation is maintained on the chain.

-

Integration of AI and automation: AI trading agents and data models are added to the market to improve efficiency and accuracy.

-

Social distribution: Embed injection ports from news to social applications, making prediction markets the default module.

-

Infrastructure: Expanding from entertainment and elections to economic data, corporate strategy, energy, and healthcare.

In 2025, prediction markets are no longer a niche experiment, but have become the main stage of finance and encryption.The next question is: Will you choose to stand on the sidelines or bet on the future?